What's a Good SaaS Churn Rate? Benchmark Your Business Based on Product Stickiness

Every SaaS founder knows the painful reality: the average monthly churn rate across the industry hovers around 8%. Hitting this average means you lose almost half of your customers every year, a rate that makes growth nearly impossible.

Chasing a universal, aspirational churn rate is a strategic mistake if you don't first understand your product's DNA. A payment gateway with a 1.5% monthly churn is facing a crisis, while a reporting add-on with the same rate might be thriving. The raw number lacks context.

As a technical founder, you need a smarter benchmark. You need to understand the relationship between your churn rate and your product’s Stickiness - the sheer, frustrating, technical difficulty involved in a customer ripping out your tool and replacing it with a competitor.

Here is the blueprint for determining a realistic, ambitious churn target based on your product's technical class.

1. The Flaw of the Universal Benchmark

The industry average is a sobering reality: 8% monthly churn is a common baseline for the general SaaS market. If you are a founder building a product for the long term, your goal must be to perform significantly better than this to achieve sustainable, profitable growth.

The key to setting an achievable target is Product Stickiness. It's the measure of technical, operational, and financial friction a customer must overcome to switch. The higher your product’s stickiness, the lower your churn rate shouldbe, and the more aggressive your target must be.

2. The Stickiness Spectrum Defining Your SaaS Class

To define an ambitious yet realistic monthly churn target, you must honestly categorize your product based on the technical effort required to replace it. The targets below represent Aspirational Performance for B2B SaaS in each class, aiming well below the 8% industry average.

Class 1: High Stickiness (Systems of Record & Core Infrastructure)

Technical Definition | Deep, API-level integration woven into the core business logic. The product holds irreplaceable historical data, security records, or transactional history. | Switching requires rewriting significant code, system-wide testing, and accepting costly downtime. |

Example Products | Payment Gateways (Stripe), Core CRMs (Salesforce), Identity Providers (Okta), Security/Compliance Tools, and Financial Ledgers. | |

Aspirational "Good" Monthly Churn Target | < 1.0% |

Class 2: Medium Stickiness (Workflow & Operational Tools)

Technical Definition | Essential for daily operations, integrated via simple APIs or webhooks. Historical data could theoretically be moved, but it would be a significant, multi-week project involving migration planning and user re-training. | Switching is a major hassle that can be done in a single quarter but carries operational risk. |

Example Products | Marketing Automation Platforms, Project Management Systems (Jira), Advanced Customer Support Helpdesks, Data Analytics Platforms. | |

Aspirational "Good" Monthly Churn Target | 1.0% - 3.0% |

Class 3: Low Stickiness (Utilities & Add-on Tools)

Technical Definition | Simple integration (e.g., a JavaScript snippet, browser extension, or single-point integration). Provides supplemental value but is easily paused or swapped out with minimal technical debt. | Switching is typically a configuration change, not a re-engineering project. |

Example Products | Website Pop-up Builders, Basic Monitoring Tools, Simple Reporting Dashboards, A/B Testing Tools. | |

Aspirational "Good" Monthly Churn Target | 3.0% - 5.0% |

3. The Technical Levers of High Stickiness

If your goal is to move your product up the Stickiness Spectrum, your engineering efforts should focus on these technical lock-in points:

API-Level Integration (The Deepest Lock-in)

Stickiness is created when your code becomes a prerequisite for the customer's code. When a customer uses your API for core, real-time functions - like calculating pricing, authenticating users, or processing transactions - they cannot simply turn it off. Every API call they rely on is a cost-of-switching multiplier.

The "Data Prison" (The Unmovable Asset)

Your product becomes sticky when it holds the customer's most critical, irreplaceable data. For High Stickiness products, this means hosting financial, security, or identity data that is too risky, time-consuming, or complex to migrate. If a customer can dump all their data into a CSV and upload it to a competitor in an hour, you have low data-based stickiness.

Internal Network Effects

Ensure the product's value increases as more seats within the customer's organization adopt it. When the data, workflows, and communication are spread across five different departments (e.g., Sales, Marketing, Engineering, Finance), the decision to leave requires sign-off from all five departments. The technical integration across multiple internal teams creates organizational stickiness.

The Switch Test

To truly understand your stickiness, conduct an internal audit. Calculate the person-hours and estimated cost it would take your own team (or a mock consultant) to switch from your product to a major competitor. The resulting number is the product stickiness you are building.

4. Strategies for Low Stickiness Products

If your product is a Low Stickiness utility, the fight for low churn is an uphill battle. You must focus your efforts on mitigation and expansion.

Integrations as Stickiness: Since your product may be easily swappable, "borrow" stickiness from other High Stickiness tools. Use Zapier, Make, or custom webhooks to build deep, essential connections to the customer’s CRM, ERP, or communication tools. By making your product the bridge between two critical systems, you make it harder to remove.

Proactive "Soft Churn" Detection: Low stickiness means a customer can decide to leave and switch in minutes. Don't wait for the cancellation button. Focus on activity metrics (last login, feature usage, weekly reporting) and build a soft churn detection system to intervene the moment a user shows signs of low engagement.

Contractual Stickiness: Use longer annual contracts and pricing tiers that incentivize commitment. A customer is less likely to switch when they've just paid for 12 months.

5. The True North Metric: Net Revenue Retention

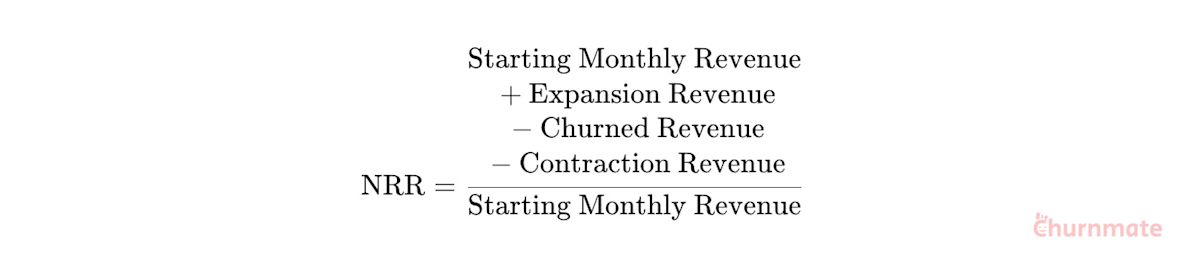

Finally, never focus on Logo Churn alone. The ultimate measure of a financially healthy SaaS is Net Revenue Retention (NRR).

For Low Stickiness products, a higher Logo Churn might be inevitable. The strategy shifts to maximizing Expansion Revenue (upgrades, add-ons, more seats) to achieve an NRR > 100%. Your goal is to make sure the revenue you gain from existing customers outpaces the revenue you lose from customers who leave.

The most successful founders do not try to achieve unrealistic churn rates; they understand their product's stickiness class, set a realistic target, and dedicate their engineering efforts to building deeper lock-in.

Anya Sharma

Anya is a seasoned SaaS enthusiast and a keen observer of the digital landscape. With a background rooted in data analytics and customer success, Anya has spent the last decade delving into what makes businesses thrive – and why some don't. She's passionate about helping small to medium-sized SaaS companies, including the vibrant community of Indie Hackers, discover actionable strategies to not just acquire, but retain their hard-earned subscribers. When she's not dissecting churn rates or crafting compelling content, you can find Anya experimenting with new coffee brewing methods or exploring hidden hiking trails. Her mission is to empower businesses with the insights they need to build lasting customer relationships.